Payroll Provider Bookkeeping Outsourcing Company in Kiev: Units Consulting Ltd Kiev, Ukraine

enero 21, 2021Кто такой senior product manager значение профессии, плюсы и минусы, зарплата, отзывы

mayo 27, 2021

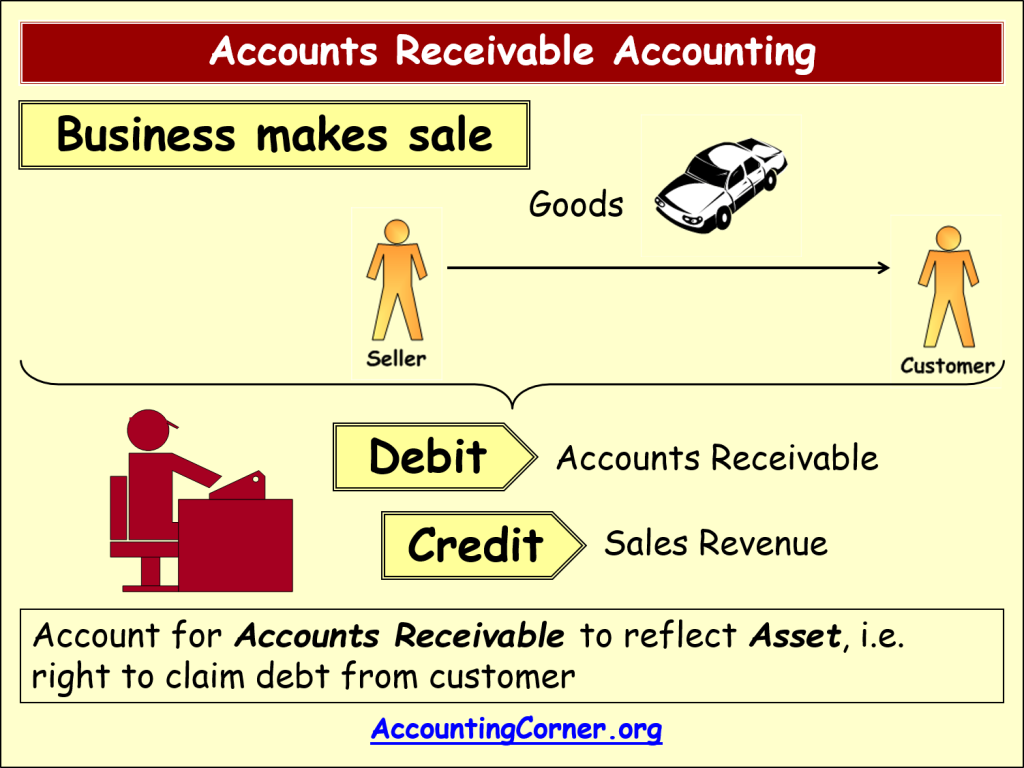

Credit policies should protect the firm against excessive bad debts but should not be so restrictive as to eliminate customers who, despite not having a perfect credit rating, are likely to pay. The debit to the cash account causes the supplier’s cash on hand to increase, whereas the credit to the accounts receivable account reduces the amount still owed. The allowance for doubtful accounts will help to reflect the actual value on the accounts receivable that the company have (accounts receivable – allowance for doubtful accounts). After all, the receivables that the customer is not going to pay have no value as they are the assets that have no economic benefits inflow to the company.

Cut off late-paying customers

Use a documented process to monitor accounts receivable, and to increase cash collections, so you can operate your business with confidence. The allowance for doubtful accounts is a more complex method used to post bad debt expenses. Accounts receivable balances that will not be collected in cash should be reclassified to bad debt expense. Firms that don’t closely monitor accounts receivable and enforce a formal collection policy may not generate sufficient cash inflows to operate. If you have to borrow from a line of credit, you’ll incur interest costs. Current asset less current liabilities equals working capital, and every business needs to generate enough in current assets to pay current liabilities.

Accounts Receivable (A/R)

Once it becomes clear that a specific customer won’t pay, there’s no longer any ambiguity about who won’t pay. Let’s say your total sales for the year are expected to be $120,000, and you’ve found that in a typical year, you won’t collect 5% of accounts receivable. You can lease renewal letter and extension agreement effectively manage increased orders and payment processing through online tools, while self-serve options can reduce the need for additional customer support members. Once the business assesses the customer’s credit, they have the option to approve or deny their order.

Accounting for Early Payment Discounts

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. In the example below, you can see how AR is portrayed on the balance sheet in one of CFI’s financial models. When goods are sold on credit, the seller is likely to be an unsecured creditor of its customer. For instance, the retail industry is famous for offering store credit with special credit cards where customers can purchase merchandise from the store and pay for it at the end of the month.

Recording the transaction upon arrival at the customer requires substantially more work to verify. From that point onward, the delivery is technically the responsibility of either a third-party shipper or the buyer. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- That is, you record accounts receivable in general ledger accounts under the account titled ‘Accounts Receivable’ or ‘Trade Debtors’.

- If that is the case, Ace Paper Mills is receiving late payments from their customers.

- Accounts receivable is the amount of credit sales that are not collected in cash.

- This process, known as “dunning,” typically involves sending reminders to these (or soon-to-be delinquent) accounts.

- Under this approach, the accountant debits the bad debt expense and credits accounts receivable (thereby avoiding the use of an allowance account).

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Receivables Under the Accrual and Cash Basis of Accounting

Such an allowance offsets the accounts receivable, meaning you subtract the allowance of doubtful accounts from accounts receivable. This is done to calculate the net amount of accounts receivable anticipated to be collected by your business. Accounts receivable turnover in days represents the average number of days your customer takes to make payment against goods sold on credit to him. However, there are times when you purchase goods on credit from your suppliers.

A higher ratio means that a company is collecting its receivables more quickly, which is a good thing. Cash reconciliation, or effective record-keeping, is important for generating accurate financial records and ensuring all payments are resolved. Promptly recording all transactions makes it easier to track any unpaid invoices and keep all financial records up to date.

By the end of Year 5, the company’s accounts receivable balance expanded to $94 million, based on the days sales outstanding (DSO) assumption of 98 days. On the income statement, the $50k is recognized as revenue per accrual accounting policies but recorded as accounts receivable too since the payment has not yet been received. While the revenue has technically been earned under accrual accounting, the customers have delayed paying in cash, so the amount sits as accounts receivables on the balance sheet. The April 6 transaction removes the accounts receivable from your balance sheet and records the cash payment. You receive the cash in April but correctly recorded the revenue in March.

Furthermore, accounts receivable are classified as current assets, because the account balance is expected from the debtor in one year or less. Other current assets on a company’s books might include cash and cash equivalents, inventory, and readily marketable securities. This means the bad debts expense account gets debited and the allowance for doubtful accounts gets credited whenever you provide for bad debts.

When receivables are discounted with recourse, the issue arises as to whether the transfer should be treated as a sale or as collateral for a loan. Other receivables that arise from loans to outsiders, employees, or stockholders should be shown separately from trade receivables. Generally, only existing legal rights are disclosed in the body of the balance sheet.

Instead of getting more flexible with your customers, which can be tempting when you’re starved for cash, develop crystal-clear guidelines for when you can and cannot extend credit to your customers. Then don’t hesitate to enforce them, even if it means turning down a few people in the short term. Accounts receivable are an asset account, representing money that your customers owe you.